Moment today announces that it has raised $36 million in Series B funding led by Index Ventures, with participation from Andreessen Horowitz, Lightspeed Venture Partners, Venrock, Neo, and Contrary Capital.

The round brings Moment's total funding to $56 million and will be used to accelerate growth, advance partnerships with leading financial institutions, invest in research and development, and continue expanding its team in New York City. Bloomberg covered the announcement here.

"Demand for fixed-income has exploded, and leading financial institutions are capitalizing on this unique opportunity to seize market share” said Dylan Parker, CEO and co‑founder of Moment. “These firms are partnering with Moment to co-create the future of fixed income - empowering their fixed income teams with a differentiated platform to win new business, unlock eight-figure revenue channels, and genuinely 10x their productivity.”

The $150 Trillion Fixed Income Market Is at an Inflection Point

The funding comes amid a period of rapid transformation for the fixed income market:

- Electronic trading has skyrocketed, with corporate bond electronic volumes growing 10x over the last decade

- Rising rates - from near zero to roughly 5% - have sparked a surge in demand

- AI advances are enabling workflow automation that was once thought impossible

The round brings Moment's total funding to $56 million and will be used to accelerate growth, advance partnerships with leading financial institutions, invest in research and development, and continue expanding its team in New York City. Bloomberg covered the announcement here.

Partnering with Leading Financial Institutions

Moment recently announced strategic partnerships with LPL Financial, the largest independent broker-dealer in the U.S. with over $2T in assets under management.

“Moment’s platform is helping us reimagine what’s possible in fixed income,” said Mike Haire, Senior Vice President of Fixed Income at LPL. “In my 25+ years of experience leading large fixed income teams, Moment is the innovative solution we’ve been waiting for and the only player in the market offering a single, unified fixed income platform for wealth management firms. Their technology enables our team to be 10x more efficient with their time while delivering enhanced execution for our advisors.”

Moment is also partnering with Sanctuary Wealth, a leading hybrid RIA and broker-dealer with over $50B in assets under management.

“Moment’s fixed-income technology is so revolutionary that our senior leadership team has started weaving it into recruiting pitches with significant advisor teams.” said Josh Freeman, Head of Capital Markets at Sanctuary. “It demonstrates Sanctuary’s commitment to delivering best-in-class technology that supports our advisors’ businesses.”

“Moment is tackling the world’s largest financial market with exceptional speed and rigor,” said Jan Hammer, Partner at Index Ventures, who was a board member at Robinhood and Adyen and will join Moment as a new board member. “Their unique blend of deep fixed‑income expertise and world‑class engineering is why the most selective financial institutions are choosing them as a strategic partner.”

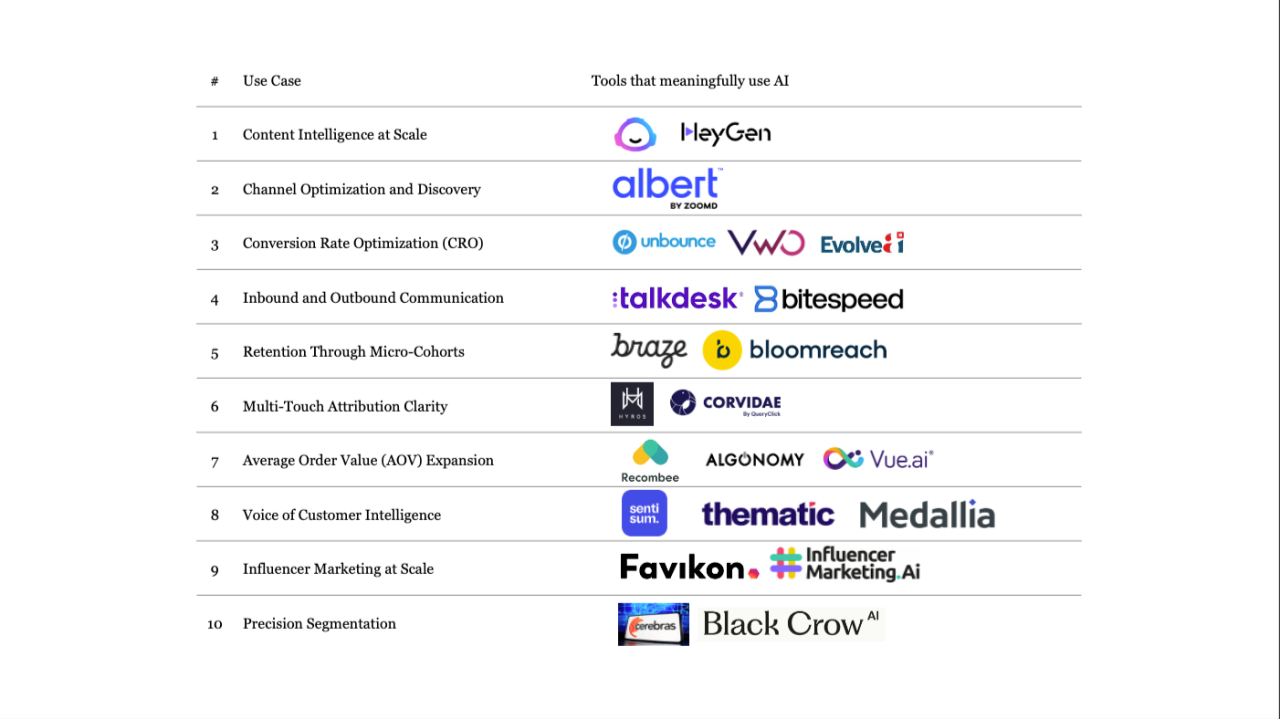

We spend a lot of time working with founders on inbound and outbound growth strategies, starting from first customer touch-points to post-purchase retention. In our view, what has changed meaningfully over the last 12-18 months is the quality and applicability of AI in customer communication. What once felt nascent is already delivering real traction and many of these use cases will go mainstream in 2026.

Below is how we are seeing AI reshape communication across different stages of the consumer journey.

AI in inbound and outbound communication is no longer about replacing humans. It’s about augmenting judgment, improving timing and increasing leverage. Founders who start building these systems early will compound faster - not because they communicate more, but because they communicate better, earlier and more selectively.

#AIinConsumer #CustomerCommunication #GrowthSystems #AtomicCapital